What is FL-150?

Income and Expense Declaration

When do you need to file FL-150?

Spouses do not have to file the FL-150 form every time they are involved in a divorce case. For instance, you do not have to file this form with the court if your divorce is uncontested, but you need to provide this form to your spouse. Sending it by mail would be enough in order to give to the court declaration regarding your financial disclosure. You always need Fl-150 for your declaration of disclosure.

Spouses are required to file FL-150 when asking for anything to do with the finical requests. For example, if you need temporary child support, temporary spousal support, or/and attorney fees

When do you need to file FL-150?

You will also be needed to complete an FL-150 form if your case is a true default. A true default case is whereby a respondent does not file a response and has no written agreement with the petitioner, 30 days after serving the petition and summons.

How to fill out FL-150?

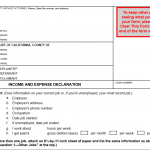

The first part FL-150 is for you to fill caption – your Name, address, e-mail address, and phone number. The next section stated, “attorney for” . If you are self-represented, place “ PROPER”

In the second box FL-150, you must fill in your court details, County where your case filed, the Name of the Court, and Address. Below this, there’s a third box where you write the name of the Petitioner, the Respondent. Please notes that Petitioner is the one who filed for the divorce ad during the whole proceeding he/she will remain petitioner. You do not need to worry about the claimant, in family law most of the time nobody else involved in the divorce. In rare cases, if another parent involved in the case, you can place another parent’s name under the claimant.

To the left just below this box, there is a part where you input the case number.

Once you’re done, you proceed to the next section where you fill in your employment details. You will indicate where you work, job title, address, and phone number.

You can place under employee address the physical address

If you don’t know an exact month, day, and year you can recall your best effort.

The next section is where you specify your age and education. You will be asked to state whether you completed high school and if you’ve completed college and graduate school, and the number of years spent in each. Lastly, you’ll need to specify if you have any professional licenses or vocational training.

Next, you will provide information about tax. When you last filed your taxes and in which state you file your tax returns. You must also state if you have any tax exemptions that you claim. After giving your tax information, you must specify the other party’s income.

If you used an extra sheet of paper, ensure you indicate the number of pieces used. After that sign and write your name at the bottom of the page.

Again on top of the second page FL-150 write the name of the Petitioner and Respondent with the case number.

After that, you will need to indicate your income and all your money sources including salary, workers’ compensation, spousal support, and bonuses just to name a few. You will also be required to write your average monthly earnings and the earnings for the previous month for each income.

There’s also a section for earnings that come from your investments such as rental income. Below that there’s a section for the self-employed and business owners where you will indicate your type of business and name.

In the ‘additional income’ section FL-150, you will be required to fill in any amount of money you have received from inheritance or winnings such as the lottery.

Below that, there is a part where you check if your financial situation has been affected and changed significantly over the last year.

After that, you will be required to specify all your deductions. This could be retirement benefits, spousal support among others. Once done with the deductions, you must indicate the value of your assets such as your bank accounts, bonds, etc. You will then move to the next page.

On the top part of the third page FL-150, you must also indicate the name of the Petitioner, Defendants, Claimants, and the case number. After that, give the details of the people you stay with. Highlight their relation to you, their age, income, and if they pay any household expenses.

In the next section, you ought to indicate your monthly expenses. This figure can either be the actual amount, estimated, or proposed expenditure. You need to specify by checking the box next to your choice. Indicate how much you spend for each category then add them to get the total expenses. You should then specify how much of this amount is paid by others.

Next, there is a section where you indicate installment payments and debts. Specify where these payments go and how much. Below that there is a part where you specify your attorney fees if you have one. On the last part of the page, there is a space for your attorney to sign and indicate the date.

On the fourth and final page FL-150 , you need to indicate the Petitioner, Respondent, and the number for your case. This page is to be completed by a party whose case involves children. In the first part, you will be required to state the number of children below 18 years who stay with the other parent.

You should also indicate the amount of time each parent spends with the children. If you are still living together, you should put 50-50 and note that you are still residing together.

After that, you will have to specify how much is spent on the children’s health and whether your employer pays for it. You should also indicate whether you have health insurance for your children.

Aside from the health expenses, you will be required to specify other additional child expenses. Some of these include health care expenses that are not covered by insurance, travel costs for visitation, and much more. Travel cost for visitation includes mostly airplane traveling expenses. If you are driving from city to city, expenses for gas would not be enough.

Section 19 is mostly self-explanatory. For example, Extraordinary health expenses not included in 18b could be a situation when your child broke his leg and the cost for medical expenses would be 1200. You can place $100 as an average monthly expense. Section 19 Expenses for my minor children who are from other relationships and are living with me, Be sure not to place child support in this section, rather extraordinary health expenses and child support for those children goes to section 19 (c,3) FL-150.

In the last section FL-150, #20, you will need to put anything that you think might help you to prevail in your case regardless of whether you are asking or defending child support. For example that you are pregnant or just had child and on maternity leave, ext.

714-390-3766

[…] have already discussed how to fill the caption of a divorce form in FL-150 and FL-115. In FL 160 the caption is filling the same way as FL -150 and FL-115. You will need to […]