Certification of trust

Use of Certification of Trust

Effect of Certification of Trust

Under the Probate Code 181100.5 (b) the trustee can show a certification of trust to prove existence or terms of the trust.

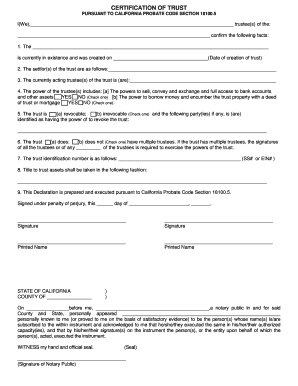

Under Probate Code 18100.5 (b) the certification of trust can contain specified information and confirm specified facts. For example, the identities of the settlors and trustee, the date of execution of the trust. It would specify whether the trust is revocable or irrevocable and if revocable who has the power to revoke the trust.

The certification of trust must specify that the trust has not been amended, revoked or modified in any manner that would make the representations in the certification incorrect Under Probate Code 18100.5 (c)it shall be notarized.

The bank or other financial institutions can ask for a specific form of certification of trust for the transaction. Some institutions can ask a customized certification. Certification of trust could be needed as a subtrust of a married settlor trust on the deceased settlor’s death if there is a change of trustee is involved (if both settlors acted as trustees) or in funding a revocable trust during the settlor’s lifetime.

The client may not want to disseminate copies of the trust when someone asked him during transfer of the property because the private information would be disposed. The certification of the trust is helpful for that purpose as well because instead of providing copy of the trust you can provide the certification of the trust.

Under Probate Code 18100.5 (b) the certification of the trust shall include

- Date of execution;

- Who is the currently acting trustee or trustees;

- Who is the settlor or settlors;

- Whether the trust is revocable or irrevocable;

- Who has the power to revoke;

- The powers of the trustee;

- If the trust has more than one trustee, whether all or some of the trustees’ signature required to sign to exercise different powers of the trust;

- How the title to trust assets should be taken;

- The tax identification number

Legal description of the property held in the trust may or may not be included in the trust.

The certification of trust must contain a statement that the certification is being signed by all acting trustees of the trust. The certification of trust needs to be written as an acknowledged declaration.

The certification of trust could be recorded in the office of the county recorder in the county where all or a portion of the real property is located. However, it does not need to be recorded in conjunction with the redecoration of a transfer of title of real property involving a trust, e.g., a deed transferring real property into the name of the trustee.

There is no requirement that the certification contain a declaration under penalty of perjury, but it would be wise to do in order to facilitate acceptance by title companies and other third parties.

Acceptance of Certification of trust

A person who acts without actual knowledge that any facts contained in the certification of trust are incorrect in reliance on a certification of trust has no liability to any other person. If someone refuses to accept the certification or demands the trust documents in addition to the certification, he is liable for any damages caused by the refusal to accept the certification, if the court determines that the person acted in bad faith.

DECLARATION OF TRUST

Declaration of trust is an oral statement or, most commonly, written document stating that the property held in the trust for the benefit of another. It is a one-page document with the notarized Trustor ’s signature, that states the Trustor(s)’ intention that his property is to be titled in the name of the Living Trust, even in the absence of any formal document such as a Trust Transfer Deed or a Grant Deed.

One of the purpose of the declaration of trust is to establish the Trustor’ intent if someone passes away after validly executing a living trust but before a deed will be executed.

Call us if you have any questions 714-390-3766 or contact us here