How California Courts Value a Spouse’s Business in Divorce: Hidden Assets, Goodwill, and Forensic Accounting

When a couple divorces in California, issues become significantly more complex when one spouse owns a business. Unlike dividing a home or a retirement account, valuing a business during divorce requires combining legal analysis with sophisticated accounting principles. Courts must not only determine whether the business is community or separate property but also accurately assess its fair market value, goodwill, cash flow, and potential hidden assets.

Because California is a community property state, many clients assume they automatically receive half of the business. But courts must first determine how much of the business is truly community property, which requires detailed financial examination. As both a family law attorney and a professional with a Master’s degree in accounting, I routinely guide clients through these complex valuation issues.

Why Business Valuation Matters in California Divorce Cases

When a business is part of the marital estate, California courts must decide two major issues:

- Ownership Characterization

Is the business separate property, community property, or a mixed asset?

This depends on:

- when the business was formed

- whether community labor contributed to its growth

- whether marital funds were invested

- whether the non-owner spouse contributed indirectly (e.g., by supporting the owner’s ability to run the business)

- Determining the Value of the Business

This is where litigation often becomes contentious. Determining how to value a spouse’s business in divorce is a specialized process involving tax returns, financial statements, goodwill calculations, and expert testimony.

How California Courts Divide a Business: Pereira and Van Camp

The heart of California divorce business asset division lies in two landmark legal formulas:

Pereira Method

Used when the owner’s personal efforts drove the growth.

➡️ Courts allocate most growth to community property.

Common with:

- law firms

- medical practices

- professional services

- small or owner-dependent businesses

Van Camp Method

Used when business growth is due to external factors, not the spouse’s efforts.

➡️ Courts treat most of the business as separate property, giving the community only a reasonable salary value.

Common with:

- manufacturing companies

- businesses with strong market-driven profits

- passive investments

These two methods are essential in valuing a business during divorce, and choosing the wrong method can result in hundreds of thousands of dollars lost.

Standard Business Valuation Approaches Used by Courts

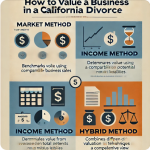

Courts rely on the same accounting principles used in private-sector valuation. Your valuation expert typically selects from:

✔ Income Approach

Projects future earnings and discounts them to present value.

Ideal for stable, profitable businesses with predictable cash flow.

✔ Market Approach

Compares the business to similar companies recently sold.

Useful when:

- comparable sales data exists

- industry benchmarks are available

✔ Asset-Based Approach

Calculates value using the company’s assets minus liabilities.

Often used for holding companies or businesses with significant equipment or real estate.

Understanding these valuation methods requires both legal insight and accounting expertise — which is why a blended perspective becomes essential when one spouse owns a business in divorce.

Goodwill: The Most Disputed Component of Business Value

Goodwill—the intangible value of a business—is almost always disputed.

There are two forms:

- Enterprise Goodwill (Divisible)

Value tied to the business itself—brand name, customer base, location, scalability.

- Personal Goodwill (Not Divisible)

Value tied specifically to the owner-spouse’s reputation or skills.

Examples:

- surgeons

- attorneys

- consultants

- real estate brokers

Properly identifying goodwill is key to understanding how to value a spouse’s business in divorce, and it often requires forensic accounting reviews.

Hidden Income and Manipulation: Why Forensic Accounting Is Often Necessary

Unfortunately, business owners sometimes attempt to minimize the value of a company during divorce. Common tactics include:

- Underreporting income

- Running personal expenses through the business

- Inflating payroll to friends or family

- Creating shell entities

- Delaying invoices until after divorce

- Accelerating expenses before valuation

A forensic accountant evaluates:

- tax returns

- depreciation schedules

- owner salary

- unexplained write-offs

- cash vs. accrual reporting

- related-party transactions

- retained earnings changes

This analysis is essential in California divorce business asset division, especially when one spouse has complete control over the business financials.

Why Legal and Accounting Expertise Must Work Together

Most attorneys understand community property rules.

Most accountants understand financial statements.

But very few professionals understand both—and business valuation in divorce cannot be properly addressed without merging these disciplines.

With an academic background in accounting and hands-on experience with FAR (Financial Accounting & Reporting), I bring a unique combination of:

- legal strategy

- financial analysis

- valuation methodology

- forensic investigation

This blended approach ensures accurate results when valuing a business during divorce.

Conclusion

When a business is involved, divorce becomes more than a legal matter—it becomes a financial investigation. California courts require precise evaluation of ownership, income, goodwill, and community contributions. Understanding how courts value a spouse’s business in divorce is essential for protecting your financial rights.

If you’re facing a divorce involving a business, whether you believe your spouse is hiding assets or you are trying to protect a company you built, you deserve representation that understands both California family law and business valuation principles.