In the aftermath of losing a loved one, dealing with legal matters can often seem overwhelming. One such legal process that individuals may encounter is the Spousal Property Petition. In this article, we’ll delve into what a Spousal Property Petition entails, how it works, its significance during the probate process, and the necessary steps to take.

What is a Spousal Property Petition?

A Spousal Property Petition is a legal document filed with the court to transfer assets from a deceased spouse to the surviving spouse without the need for a full probate proceeding. It allows the surviving spouse to claim property that was solely owned by the deceased spouse or held in joint tenancy.

How Does a Spousal Property Petition Work?

When a spouse passes away, their assets typically go through the probate process to determine how they will be distributed. However, in California, if the assets were solely owned by the deceased spouse or held in joint tenancy, the surviving spouse can file a Spousal Property Petition to transfer these assets directly to them.

Let’s provide more detailed information on when a Spousal Property Petition (DE 221) should be filed specifically within the scope of the probate process and the circumstances that lead to it:

When to File a Spousal Property Petition in Probate:

-

Clear Ownership of Assets:

- A Spousal Property Petition is typically filed when there are assets solely owned by the deceased spouse or held in joint tenancy with the surviving spouse.

- This situation commonly arises when the deceased spouse had assets in their name alone or had jointly owned assets with the surviving spouse.

-

Assets Subject to Probate:

- The need for a Spousal Property Petition becomes apparent when assets subject to probate need to be transferred to the surviving spouse.

- Probate assets include real estate, bank accounts, investment accounts, vehicles, and other personal property solely owned by the deceased spouse.

-

Completion of Preliminary Probate Tasks:

- Before filing the Spousal Property Petition, it’s essential to complete certain preliminary tasks in the probate process.

- These tasks may include notifying creditors, inventorying assets, resolving outstanding debts and expenses, and obtaining court approval for the inventory and appraisal of assets.

When Should a Spousal Property Petition be Filed?

Let’s delve into more specific details regarding when to file a Spousal Property Petition (DE 221) in the probate process in California.

-

Initial Steps in Probate:

- The probate process typically begins with the filing of a petition for probate with the court. This initiates the formal administration of the estate.

- After the petition is filed, the court will appoint an executor or administrator to oversee the probate proceedings.

-

Notification of Creditors:

- One of the early steps in probate involves notifying creditors of the decedent’s passing. This notification period allows creditors to make claims against the estate for any outstanding debts.

-

Inventory and Appraisal of Assets:

- The executor or administrator is responsible for creating an inventory of the decedent’s assets and obtaining appraisals, if necessary, to determine their value.

-

Resolution of Debts and Expenses:

- Before assets can be distributed to beneficiaries, the estate must settle any outstanding debts, taxes, and administrative expenses.

-

Preparation for Asset Distribution:

- Once debts and expenses have been resolved, and the estate’s assets are ready for distribution, it’s time to consider filing the Spousal Property Petition.

-

Filing the Spousal Property Petition (DE 221):

- The Spousal Property Petition (DE 221) should be filed with the court after the preliminary tasks of probate have been completed, but before the final distribution of assets.

- Specifically, it’s advisable to file the petition after the court has approved the inventory and appraisal of assets, and any outstanding debts and expenses have been resolved or addressed.

-

Timing Considerations:

- Filing the Spousal Property Petition at the appropriate time is crucial for expediting the transfer of assets to the surviving spouse.

- Waiting until the later stages of probate could result in unnecessary delays in asset distribution.

Purpose of Filing During Probate

The primary purpose of filing a Spousal Property Petition during probate is to streamline the transfer of assets to the surviving spouse. By bypassing the lengthy probate process for these specific assets, the surviving spouse can gain quicker access to the property and avoid unnecessary delays and expenses associated with probate.

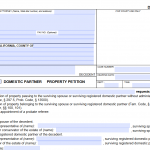

How to Fill Out DE 221

Filling out DE 221, the Spousal Property Petition form in California, requires attention to detail and accuracy. The form typically includes information such as the names of the deceased and surviving spouses, a description of the property being transferred, and a declaration of the surviving spouse’s rights to the property. It’s essential to follow the instructions provided with the form carefully and ensure all required information is accurately provided.

Alternatives to Filing a Spousal Property Petition

While a Spousal Property Petition can be an efficient way to transfer assets to a surviving spouse, it’s not the only option available. One alternative is to establish a living trust. A living trust allows individuals to transfer assets to their beneficiaries outside of probate, thereby avoiding the need for a Spousal Property Petition altogether. Additionally, a living trust offers privacy, flexibility, and control over asset distribution, making it a valuable estate planning tool for many individuals.

In conclusion, a Spousal Property Petition is a crucial legal instrument for transferring assets from a deceased spouse to a surviving spouse during the probate process in California. By understanding its purpose, filing requirements, and alternatives, individuals can navigate the complexities of estate administration more effectively and ensure the efficient transfer of assets to their loved ones.